Citywide Land & Development, LLC #5673-5680 | TEXAS – FUNDED

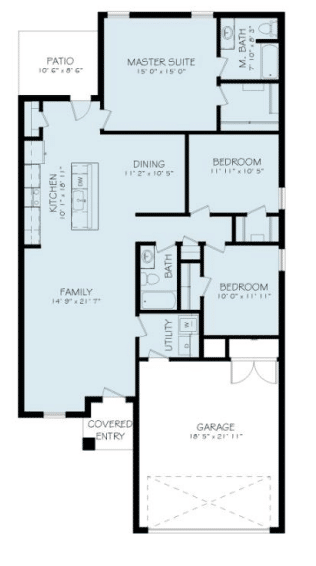

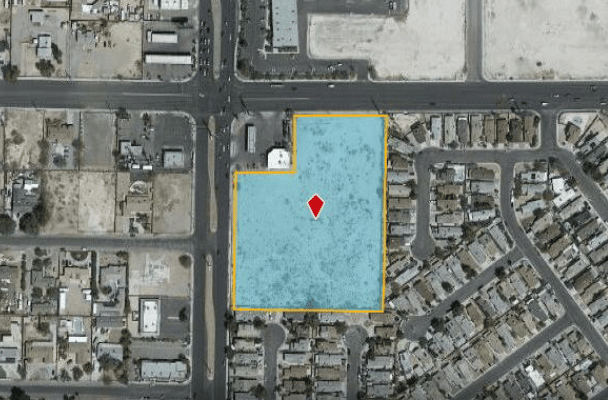

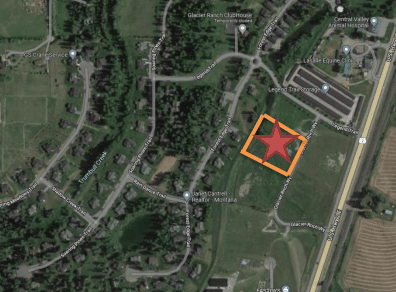

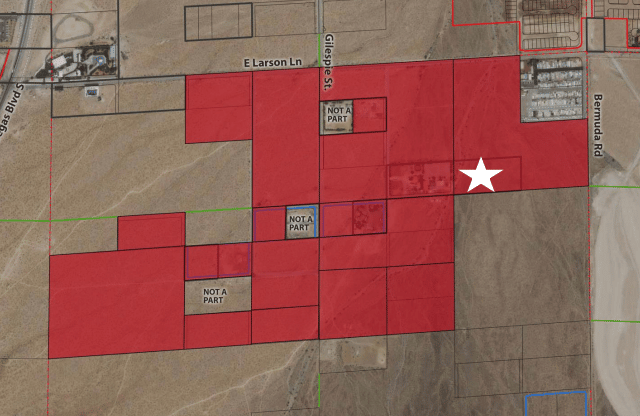

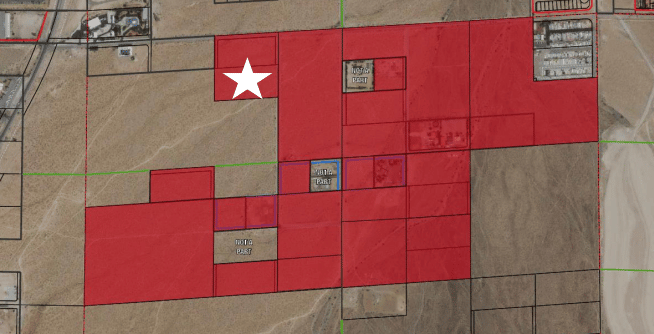

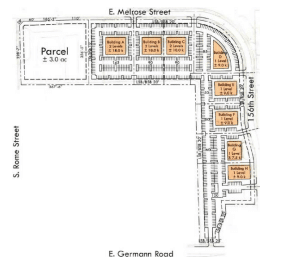

First Trust Deed collateralized by eight fully built residential homes in Midland, TX (about 330 miles west of Dallas, TX and 120 miles south of Lubbock, TX). Ranked as one of the fastest growing micro cities in America, there is a need for new housing supply in this area. The borrower is purchasing these eight completed units from Betenbough Homes as an end of year effort to clear inventory of the sellers’ books. The borrower is under contract to purchase (or already closed on) a total of 23 completed homes over a 45-day period at a discounted price. Our borrower will then lease up the properties and sell the rented units to their investors as cash flowing assets. Each home sits on approximately .12 acres of land with homes ranging from 1350 to 2050 square feet in size. The borrower and seller have a long track record of performance which is part of the reason our borrower can get these units at such a discount. Master Loan Amount: $2,110,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. Term: Nine months with no extensions available. Final