GGD Oakdale, LLC #4791 | MICHIGAN – FUNDED

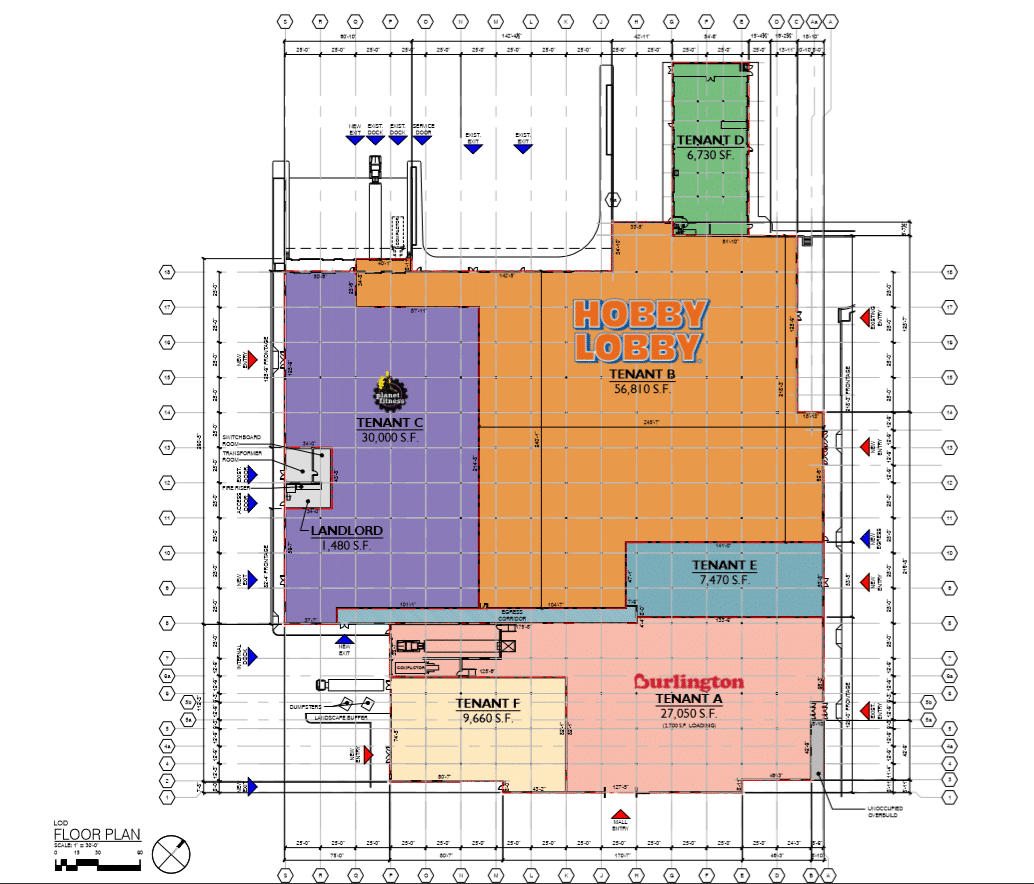

First Trust Deed collateralized by an approximately 136,000 square foot former Sears building which is part of the larger Jackson Crossing Shopping Mall in Jackson, MI (about 78 miles east of Detroit, MI). Current tenants in this mall include national brands such as Kohl’s, T.J. Maxx, Bed Bath & Beyond, Best Buy, and Target (these tenants occupy property inside the mall but not the collateral of this loan). Since acquiring the site in December of 2019, the borrower has demised the interior of the Sears building and updated the property to new building codes. Going forward, the borrower needs additional capital for the specific tenant improvements to the six new suites (the floor plan is on the next page). Tenants such as Hobby Lobby, Burlington, and Planet Fitness have all signed leases or letters of intent. These three tenants would occupy over 80% of the space and the remaining three smaller suites would be rented to local tenants once they are procured. With average lease rates of $7.00 per square foot, the property will generate enough cash flow to cover interest payments with just the three tenants already identified. Loan Amount: $6,100,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal