Grays Development Company, Inc #5051-5056 | COLORADO – FUNDED

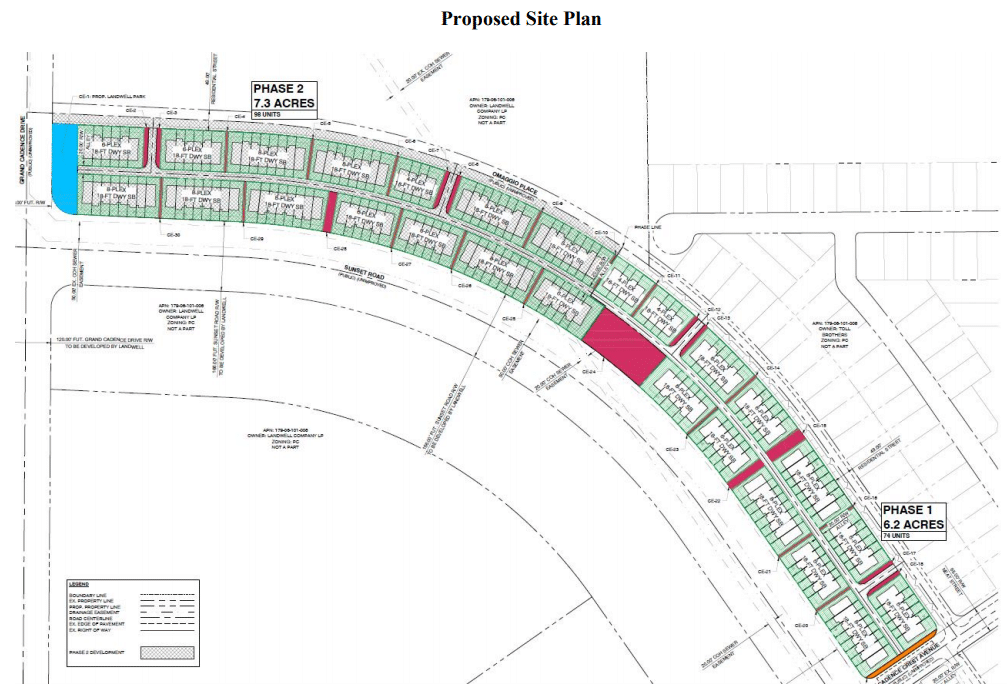

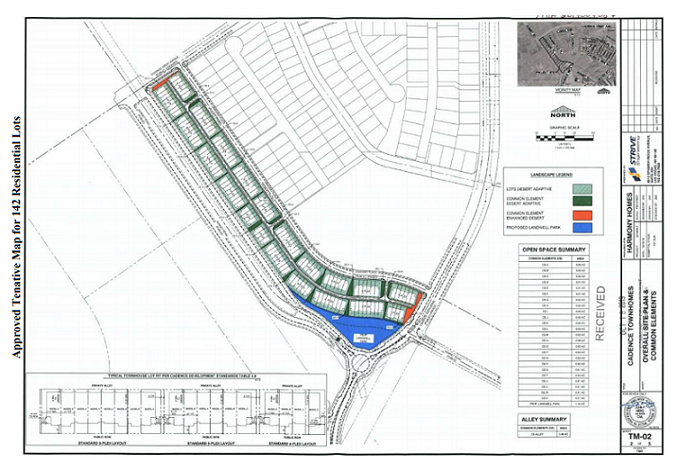

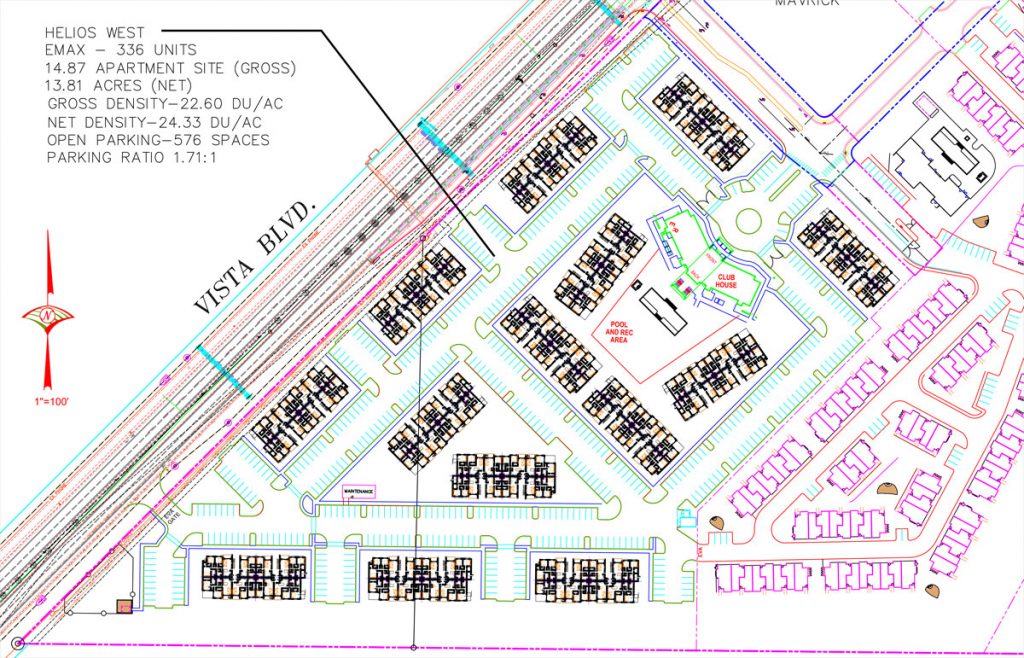

The collateral for this loan consists of 61 platted and partially developed townhome lots located in Colorado Springs, CO (approximately 61 miles south of Denver, CO). These 61 lots are part of a larger 221 lot community know as Victory Ridge which the borrower acquired about two years ago. The townhomes will average 1,500 square feet in size with an anticipated sales price averaging over $380,000. This is the third takedown the borrower has elected to take from the seller. Lokal Homes has the option to purchase the remaining lots within Victory Ridge and are slated to do so later this year. Lokal Homes, the home builder of this project, is averaging six sales per month so far this year. Directly to the north of the property is a newly opened Icon Cinema in a growing “Interquest Corridor”. Loan Type: This Master Loan will be sold in tranches, giving investors the opportunity to invest in one or more lots in the community. Yield: 10.00% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. Term: 9 months with two optional 9-month extension period at maturity.