Gold Rose Construction, LLC #5080 | NEVADA – FUNDED

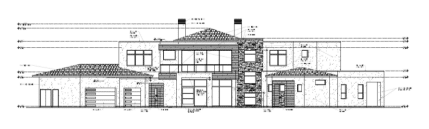

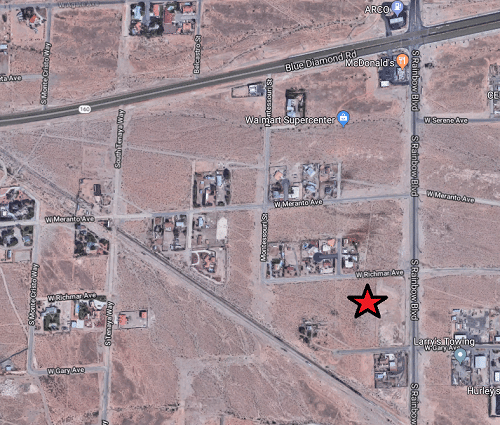

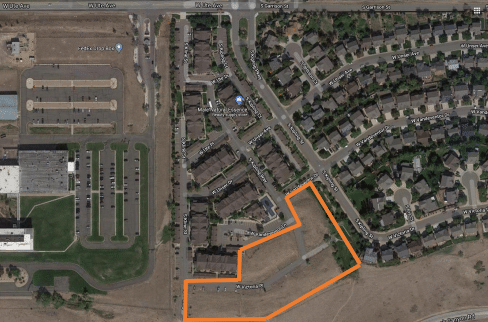

The collateral for this loan consists of an approximately half acre lot within the Kensington Manor Subdivision. Proceeds of this loan will be used by the borrower for the construction of an approximately 7,000 square foot two story home and casita. Located in the Northern part of Las Vegas (approximately 18 miles northwest of downtown Las Vegas, NV), this highend home will consist of five bedrooms and seven bathrooms. Additionally, there will be a four-car garage and space for a pool. This is the third construction loan originated by Ignite for the construction of a home within the community. One of the two previous construction loans is under contract to be sold to an end user. Loan Amount: $2,384,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity.