Copper Cart, LLC #5374 | NEVADA – FUNDED

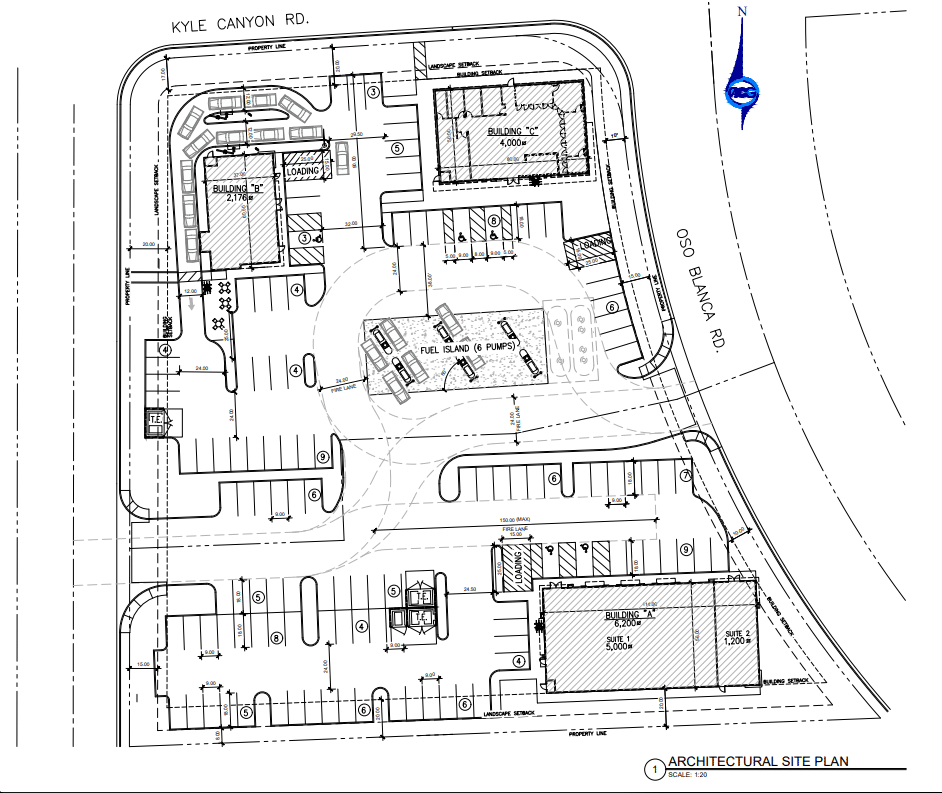

The collateral for this loan is a 1.12-acre piece of land located near the corner of Centennial Parkway and Durango Drive. Building permits will be issued shortly for the borrower to start the construction of an 8,555 two tenant retail center. Both suites are preleased with the larger of the two suites leased to Born & Raised “BAR” which is a sports-focus bar catered towards locals. The other suite is preleased to “Firefly Tapas Kitchen & Bar” which has been around since 2003 and a quickly become a locals’ favorite. This is the second building within the center the borrower has constructed and is very similar to multiple other locations they have done over the past few years. Current leases will have the property producing over $380,000 in annual net revenue when completed. Loan Amount: $2,000,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 10/20/23