Mosaic Seven, LLC #5549 | NEVADA – FUNDED

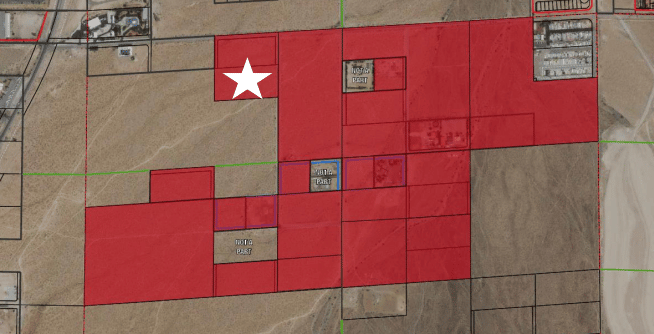

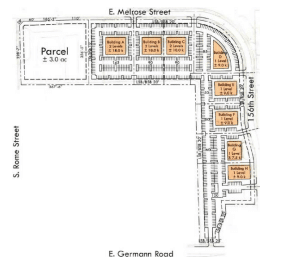

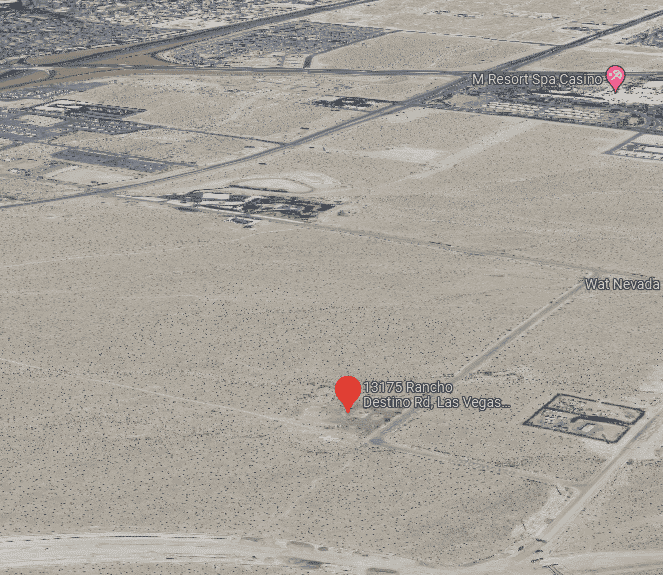

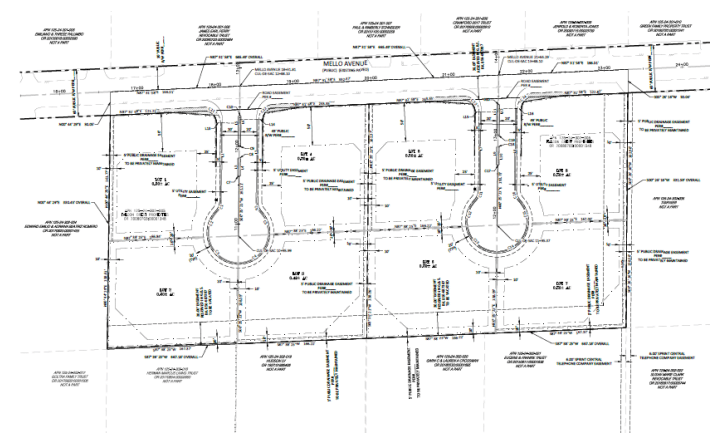

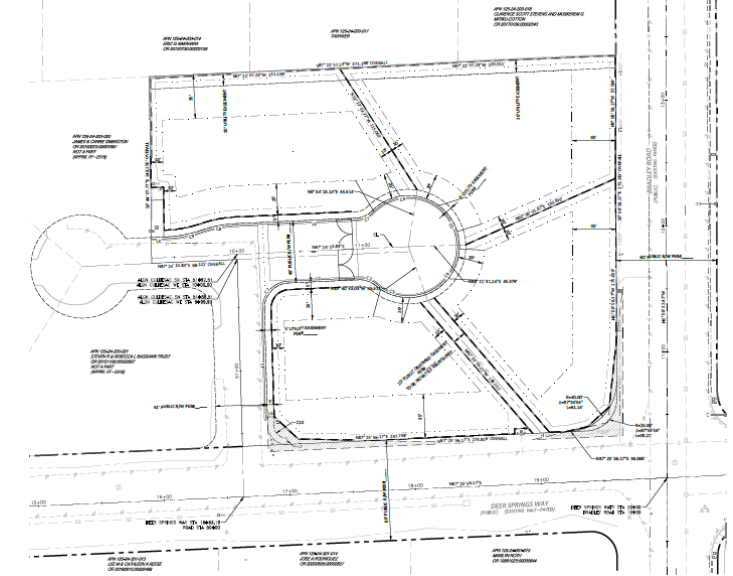

The collateral for this loan is a five-acre parcel of vacant land located in the fast growing “West Henderson” area of Las Vegas, NV. Given the areas prodevelopment city officials, the area has seen robust growth in the past few years with much more development planned in the near future. Although the property does not currently have a zoning classification, it is the intent of the borrower to get approval to allow for a multifamily development as part of the entire planned unit development in addition to this property, the borrower also owns or controls over 170 additional acres in the area. One of the advantages of parcels in the area is that city officials should be willing to support both residential as well as industrial developments around this area giving the borrower some flexibility with potential uses. Loan Amount: $3,258,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 2/23/24.