GGD Oakdale, LLC #5729 | NEW MEXICO – FUNDED

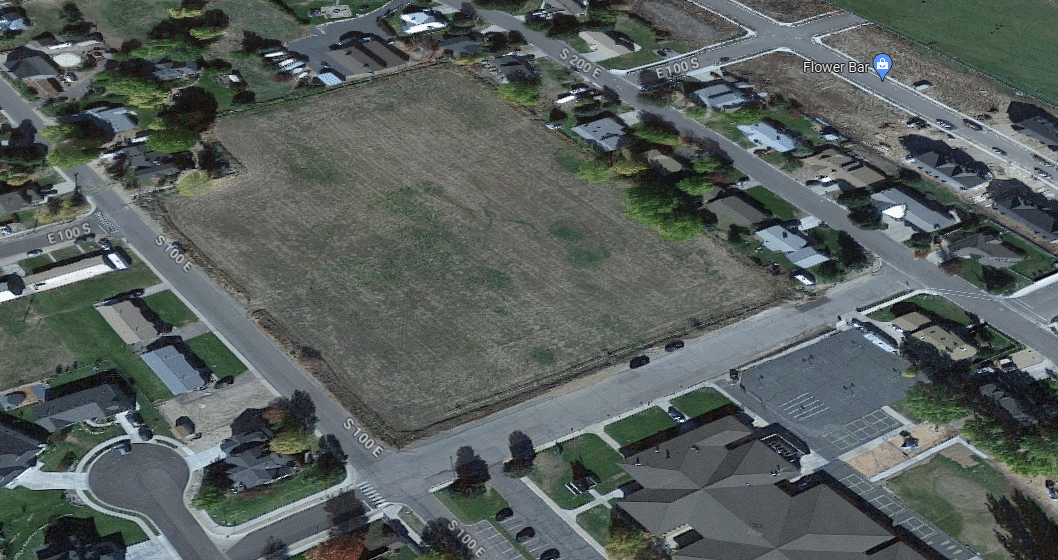

The two parcels that are the collateral of this loan sit directly across from the newly renovated luxury apartments known as Blvd 2500 (currently owned by an affiliated company of the borrower). Since acquiring the site in 2016, the borrower has converted the preexisting hotel into the apartment buildings and demolished the indoor waterpark. This “excess land” that we are encumbering will be retained by the borrower even after he sells the apartments. Currently, the borrower is finalizing the lease with a large gas station company as well as large coffee shop who will each operate drive through pads. The gas station will operate on a ground lease meaning the tenant is responsible for everything built on the property and the owner retains ownership rights. The coffee shop will be leased as a “normal” transaction after the borrower constructs the building. Loan Amount: $3,700,000 Yield: 10% interest Schedule: Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 9/28/24.