17th and Sheridan, LLC #5976 | COLORADO – FUNDED

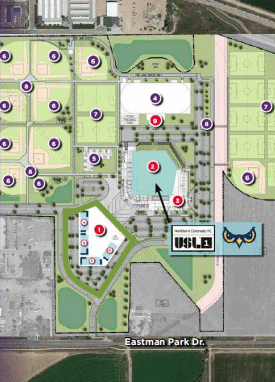

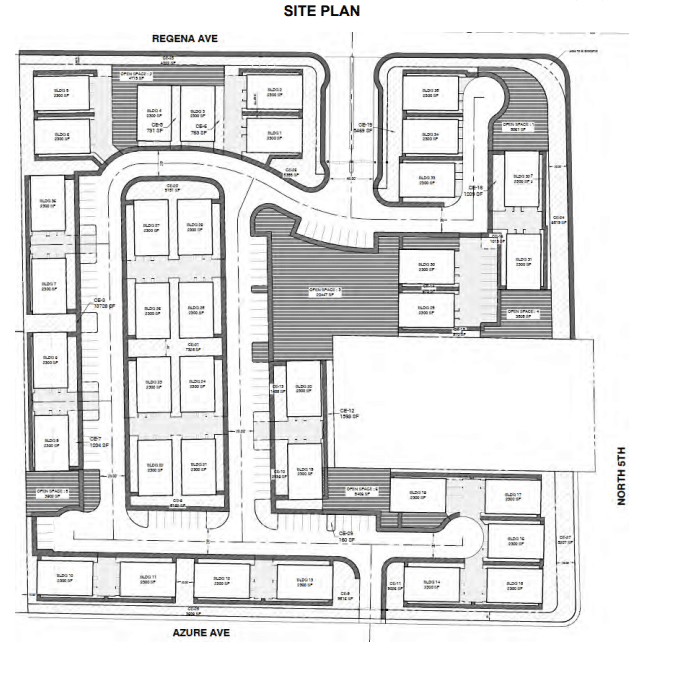

First Trust Deed collateralized by a parcel of land on the Southeast corner of 17th Ave and Sheridan Blvd in Denver, CO. This site is directly across the street from Sloan’s Lake, the second largest park in Denver and one of Denver’s fastest growing neighborhoods. The site allows for a high-density residential redevelopment project. The city has already approved a 67-unit garden style for sale, stacked flat product (an artist’s rendering is shown in the picture above). Although this loan is just to refinance the acquisition of the project and to complete the development work, the total project cost will be nearly $16,000,000. Over the coming months, the borrower will work with subcontractors to finish the site development work in an effort to get the project ready for vertical construction. It is anticipated the borrower will be able to pay off this loan with construction financing in about six months. Master Loan Amount: $6,500,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity