Blue Heron Oasi, LLC #5153 – 5177 | NEVADA – FUNDED

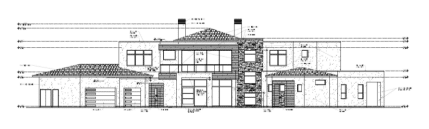

First Trust Deed collateralized by nearly 13 acres of residential land near the corner of Warm Springs and Pecos in Las Vegas, NV (approximately 11 miles south of downtown Las Vegas). Since going under contract on the land, the borrower has received approval to build four extra homes than the previous zoning allowed and to build two story homes instead of the one story that was previously permitted. The additional four homes have created an additional 20% of value that the previous owner was unable to “unlock”. Maybe more importantly, the homes will now be two story homes which will give them enough height to overlook the surrounding homes and have views of the Las Vegas Strip. “Strip” views, no matter the location within Las Vegas command a premium over surrounding properties. Once the property is purchased, the borrower will begin development on the site. Ignite Funding intends to be the development lender as well. Master Loan Amount: $6,960,000 Tranche Loan Amount: $290,000 Loan Type: This Master Loan will be sold in tranches, giving investors the opportunity to invest in one or more lots in the community. A breakdown of the lots is shown on the next page. Yield: 10.00%