Harmony Homes Nevada, LLC #5916-5922 | NEVADA – FUNDED

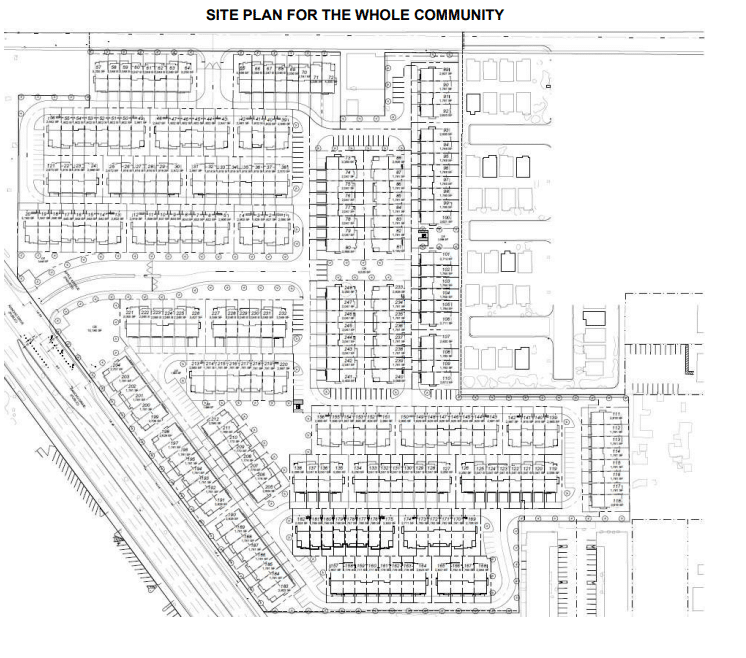

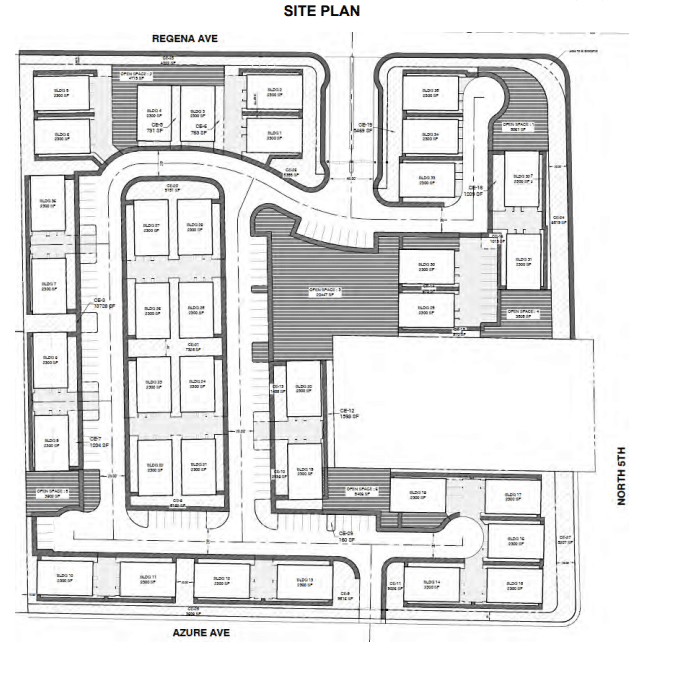

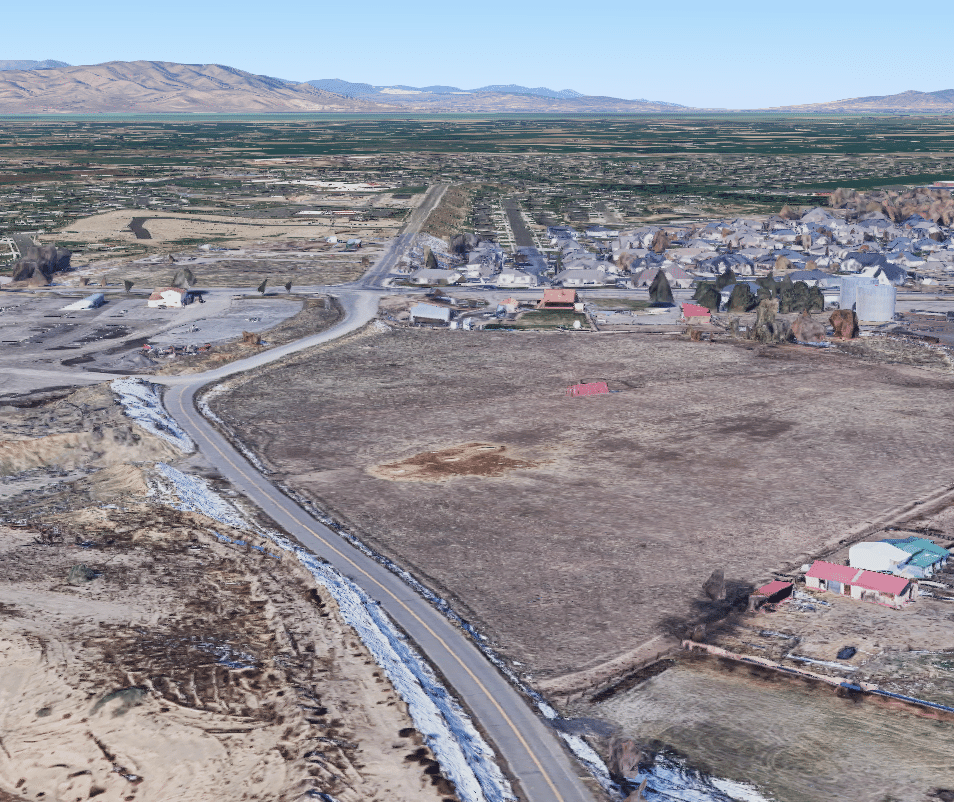

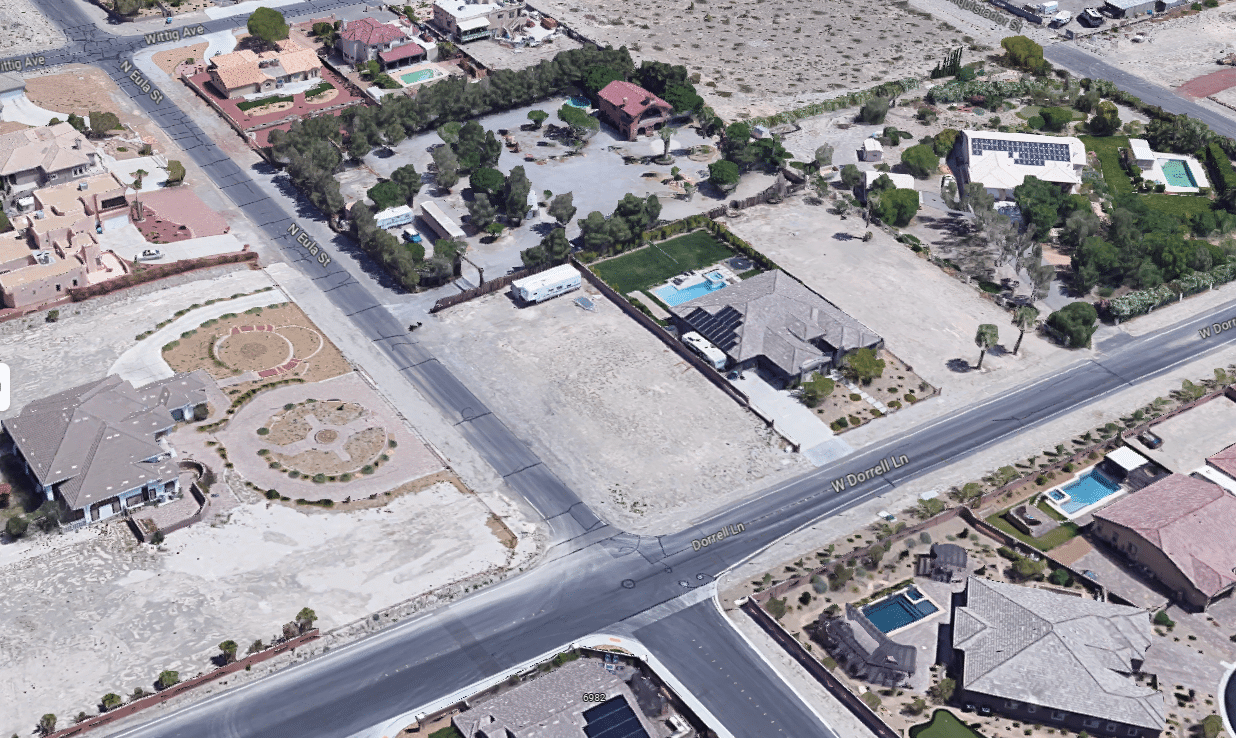

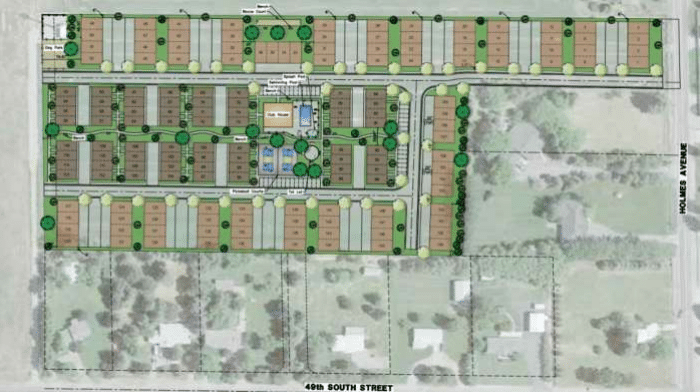

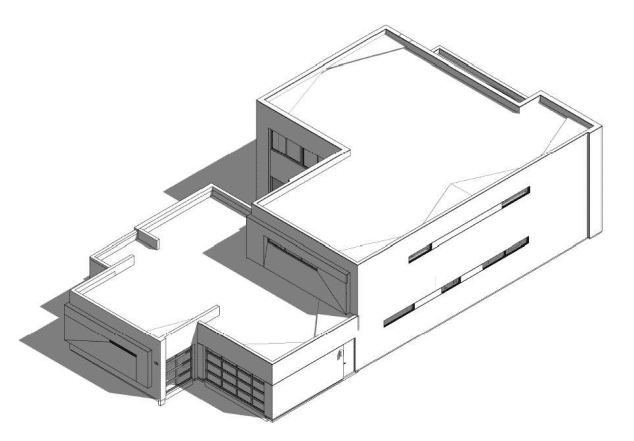

First Trust Deed collateralized by 94 substantially completed residential lots near the corner of Vegas Dr and Rancho Dr (five miles northwest of downtown Las Vegas, NV). Since purchasing the property nearly five years ago, the borrower worked with the city to get a 248-lot community approved. The first phase of the community began selling in 2022 and will continue until all 148 lots in the first phase are done. All homes in this first phase have been sold with an average sales price of approximately $340,000. This loan encumbers most of the second (last) phase of the community. The borrower anticipates being sold out of the community in early 2025 Master Loan Amount: $3,102,000 Yield: 10% iterest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 2/6/25.