GGD Oakdale, LLC #4817 | NEW MEXICO – FUNDED

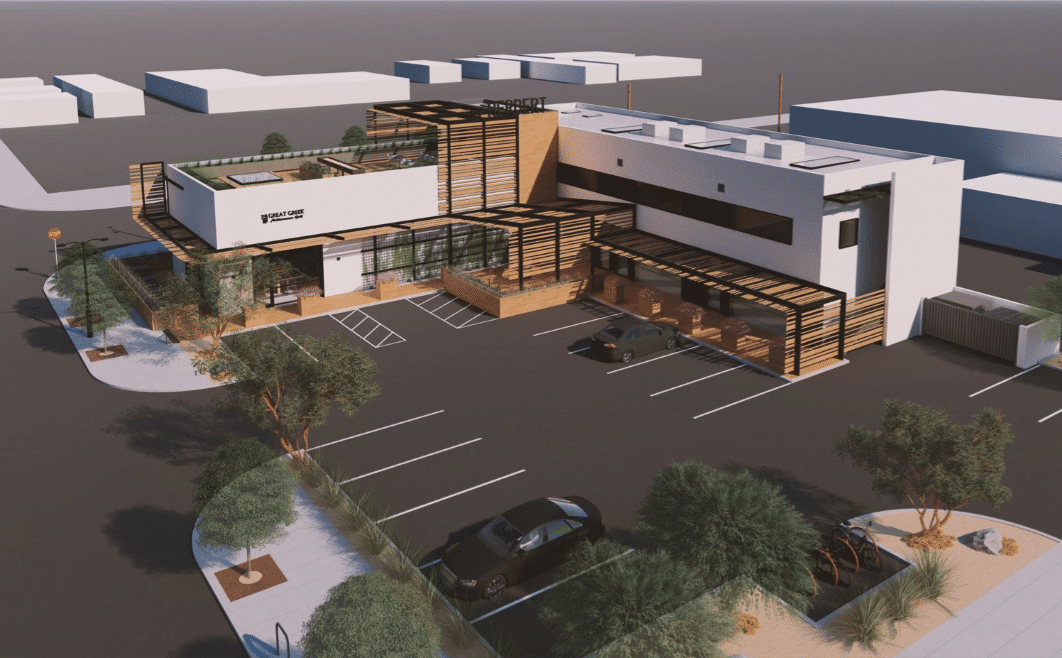

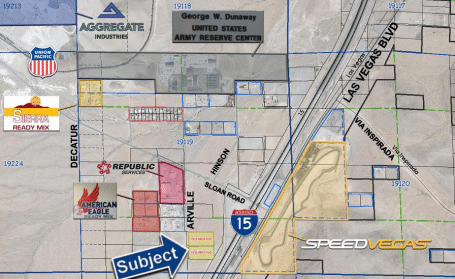

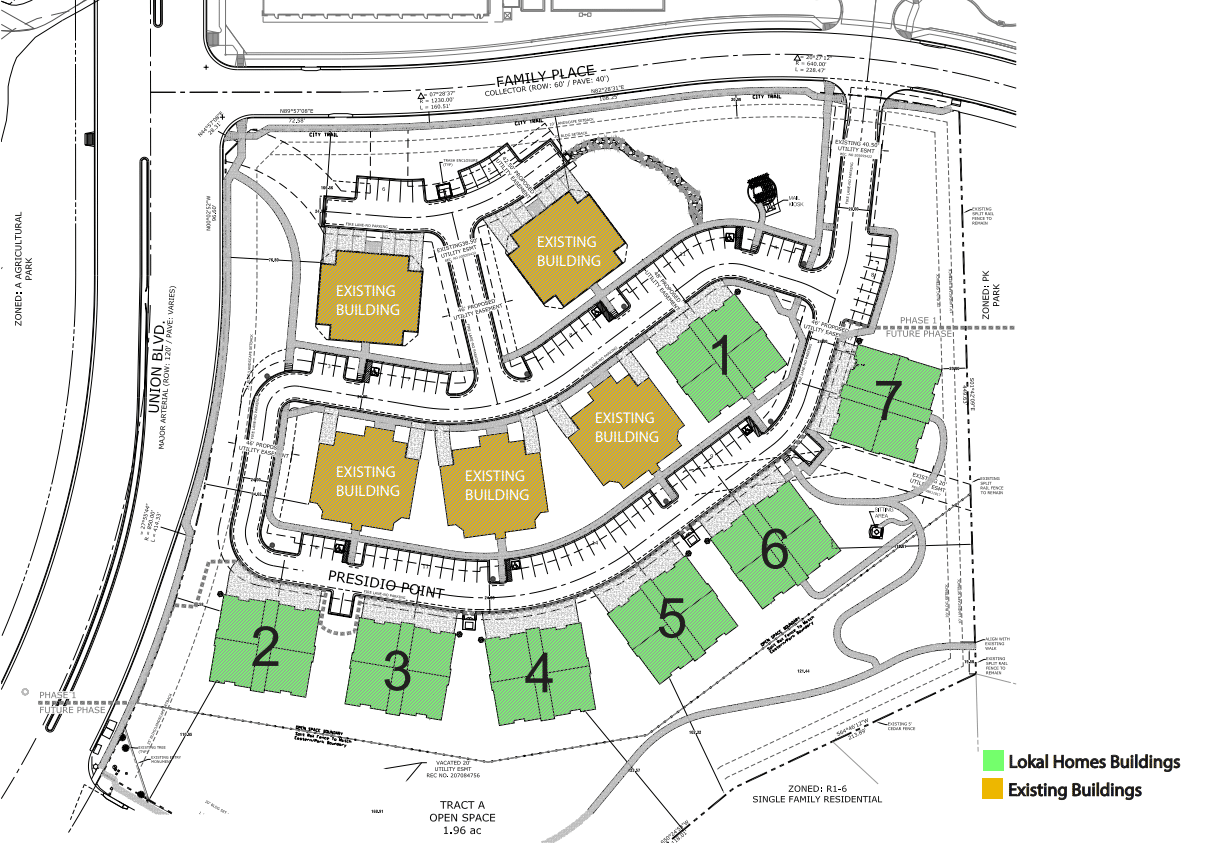

First position deed of trust collateralized by two office towers totaling approximately 264,000 square feet, covering 9.31 acres, near the heart of Albuquerque, NM. Currently the property is only 30% leased but the major tenant, The New Mexico Department of Health, is looking to expand and extend their lease. The borrower intends to upgrade the façade of the building, the lobby, and the HVAC system of the 17- story building. Once this work is completed the borrower will consolidate all tenants into the 17-story tower and completely vacate the 10-story building. Once accomplished, the 17- story tower will be over 50% leased at which point they will look to refinance the loan. Upon completion of the main tower, Ignite will release the deed of trust on the vacant 10-story building since we will have sufficient collateral which will allow the borrower to get construction financing to convert the property into approximately 150 apartment building. This is the same strategy he implemented in Albuquerque with a converted hotel. Loan Amount: $4,800,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day