CherCo, LLC #5069 | NEVADA – FUNDED

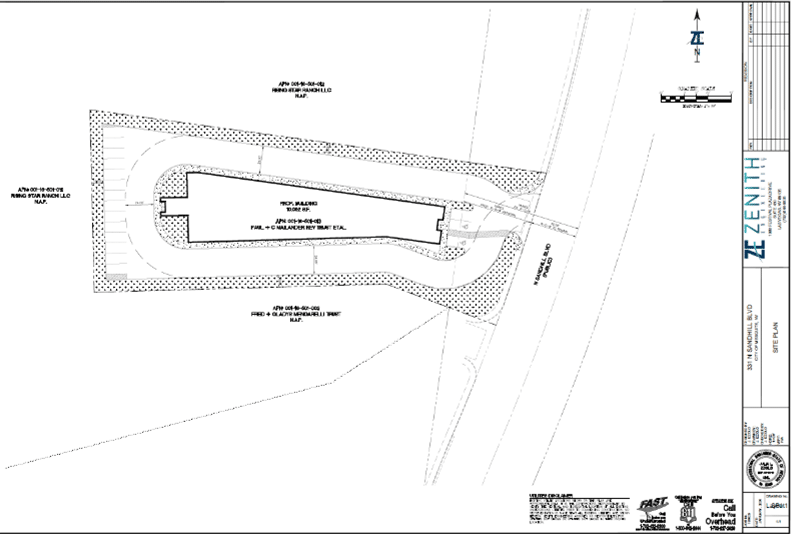

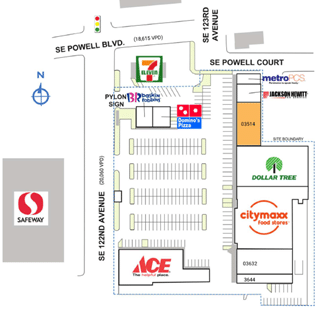

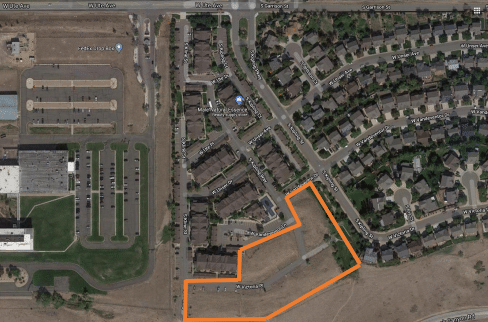

The collateral for this first position loan is an approximately one-acre site in Mesquite, NV (approximately 80 miles northeast of Las Vegas, NV). The borrower is acquiring this parcel of land after being under contract to purchase since July of 2018. During the extended escrow process, the borrower has successfully worked with the city to vacate a road that would have run through the site as well as get preliminary approval for the construction of a 10,000 square foot retail building. Although not encumbered by this loan, FedEx, Jack in the Box, Smiths Food and Drug, Subway, KFC, and Starbucks are all in the immediate vicinity of this parcel illustrating the other national retailers that believe in this location. The principals of the borrower have worked in the industrial and retail sectors of real estate in and around Las Vegas for over three decades. Loan Amount: $500,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional ninemonth extension at maturity