Hurry It Up We Are Burning Daylight, LLC #5316 | NEVADA – FUNDED

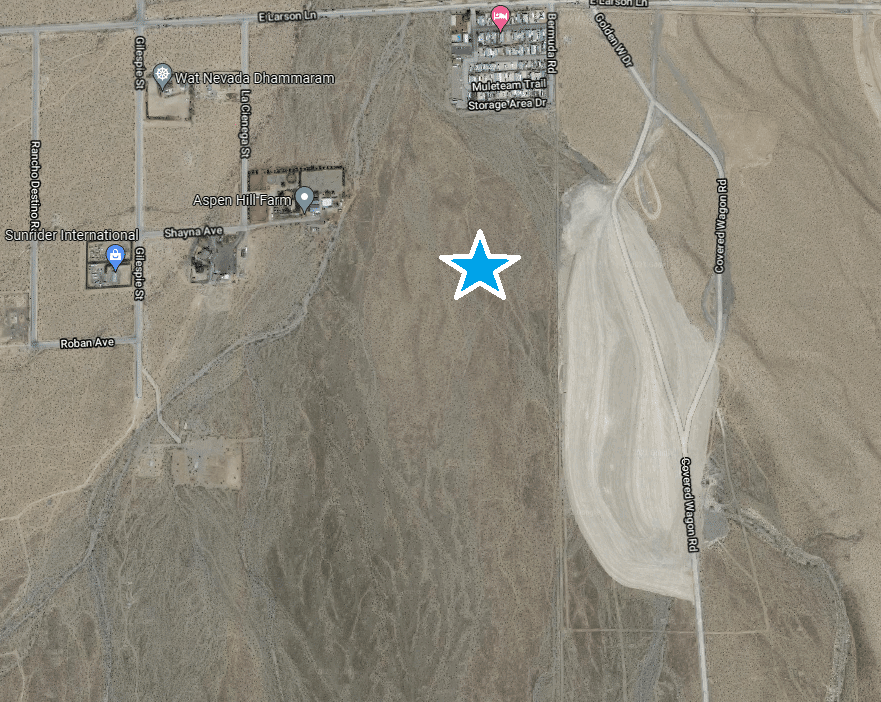

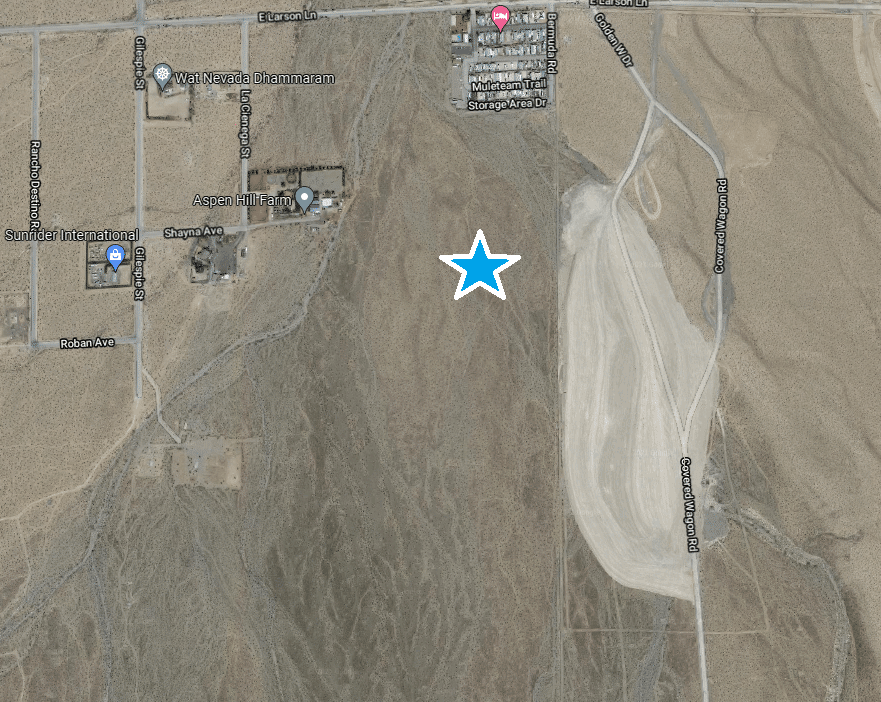

The collateral for this loan is 1.88 acres of land located in Sandy Valley, NV which is about 34 miles southeast of the M Resort (the south point of the Las Vegas Strip). Since acquiring the property in June of 2020, the borrower has worked with the city to allow for the construction of a 10,500 square foot building. The property is 100% preleased to Family Dollar which is a wholly owned subsidiary of Dollar Tree and has been in operations for over 60 years and currently has over 15,000 stores and 250,000 employees. This is one of 600 planned new stores this year for Dollar Tree. Construction is already in full swing and is expected to be completed in four months. Once the property is constructed and the tenant has occupied the property, the borrower will pay this loan off via a refinance. Loan Amount: $1,796,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extensions at maturity.