Our Pledge to our Investors

Ignite Funding believes strongly in transparency to our Investors, which is why every year we release our Loan Portfolio Performance Record with supporting data. The information contained within the Performance Record includes the following statistics; number of Borrowers, aggregate number of loans and amount funded, loan type by percentage, average annual interest rate paid to Investors, aggregate loan-to-value ratio, average duration of loan terms.

2011 – End of Q4 2023 Loan Portfolio Performance Record

Acquisition Loans***

55% Residential

45% Commercial

81 Borrowers****

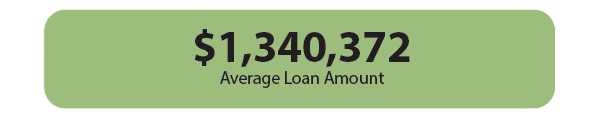

$962,084,100 Total amount funded

634 Loans funded

10.38% Average annualized interest rate to investors*

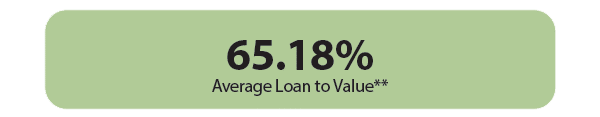

60.90% Avg Loan to Value**

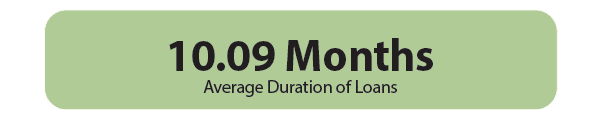

11.55 Avg duration of loan term (months)

$95,815,486 Income Paid to Investors

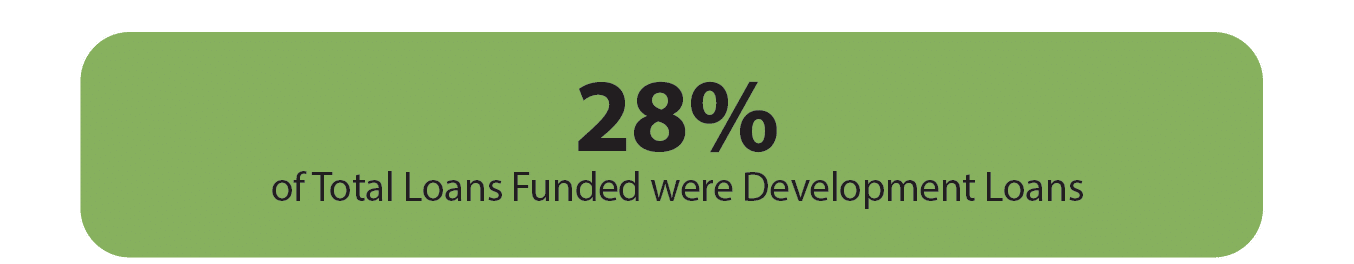

Development Loans

81% Residential

19% Commercial

24 Borrowers****

$489,570,550 Total amount funded

224 Loans funded

10.18% Average annualized interest rate to investors*

68.09% Avg Loan to Value**

9.03 Avg duration of loan term (months)

$35,785,152 Income Paid to Investors

Construction Loans

65% Residential

35% Commercial

34 Borrowers****

$321,657,200 Total amount funded

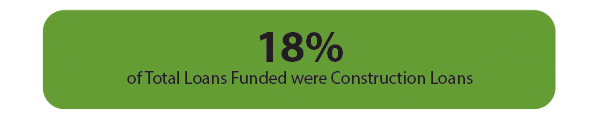

465 Loans funded

10.13% Average annualized interest rate to investors*

69.37% Avg Loan to Value**

8.90 Avg duration of loan term (months)

$24,426,984 Income Paid to Investors

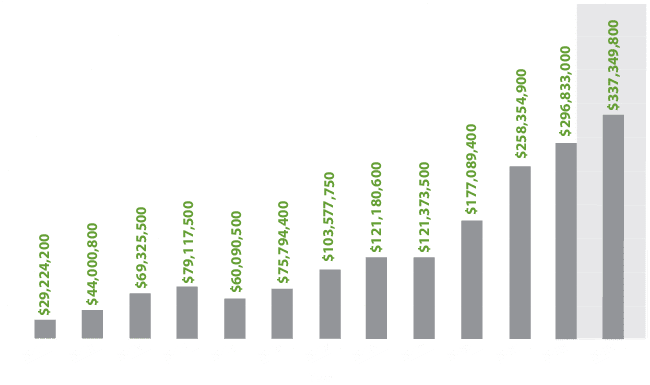

Total Loans Funded by Year

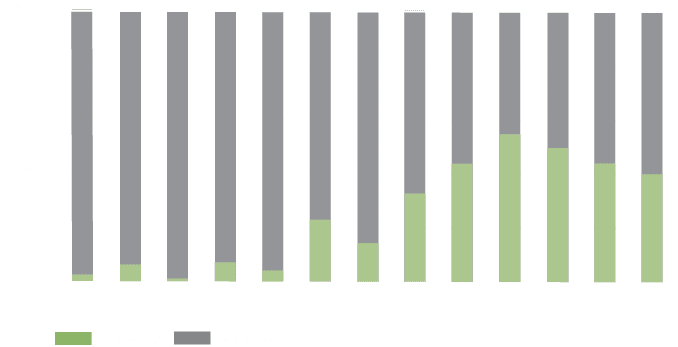

Commercial vs. Residential Fundings By Year

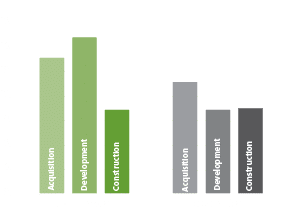

Average Duration of Loans By Loan Type

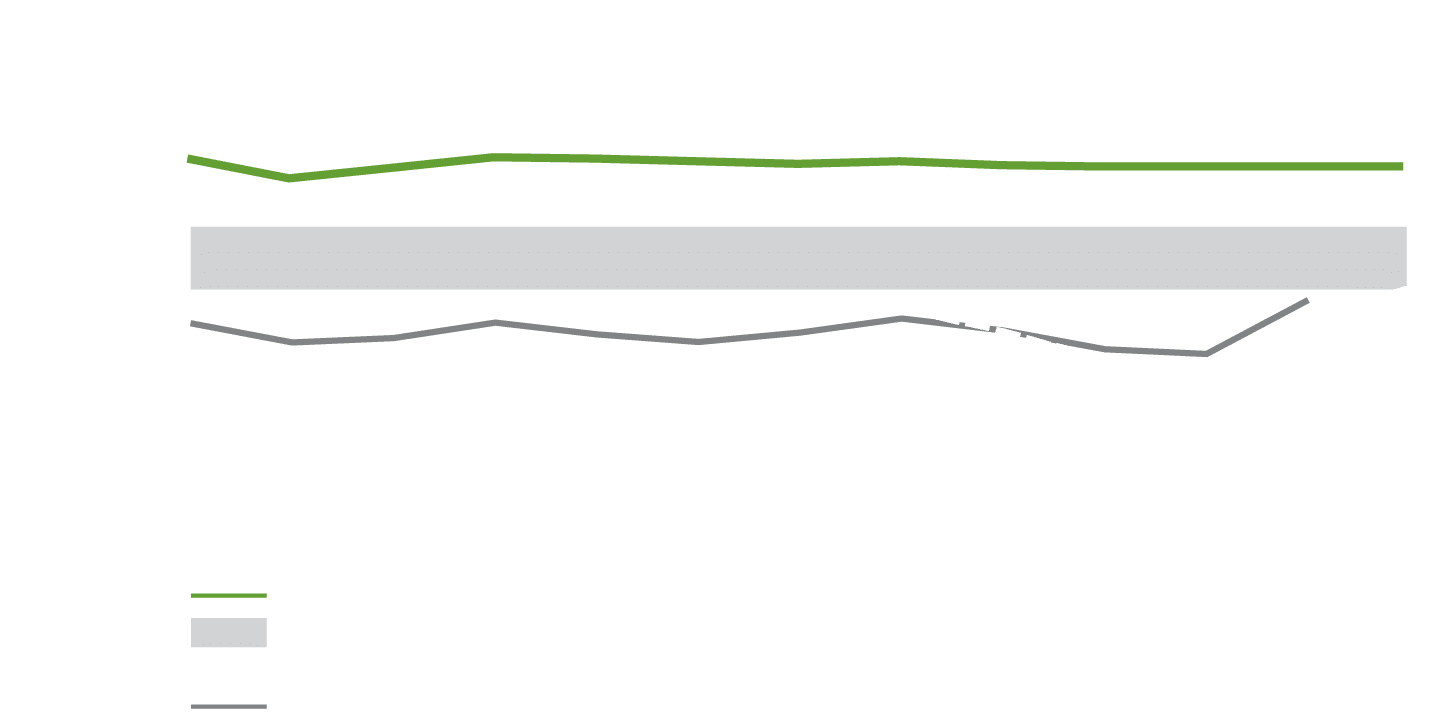

Residential and Commercial Borrowing Rates

Information reflected above is for loans funded in 2011 through Q4 of 2023. *Average annualized interest rate to investors is based upon the annualized interest rate received by investor(s) is dependent upon the payoff before maturity or extension of the loan term. Some loans may payoff before the loan terms which would decrease the duration of the loan, and others may have extensions available that could increase the duration of the loan. **Loan to Value is determined by an appraisal, Broker Price Opinion (BPO), or the valuation provided by the County Assessor’s Office. Loans with an appraisal wavier are not included. *** An acquisition loan includes raw land and/or an existing structure. ****Number of borrowers calculated uniquely by point of contact per segment.