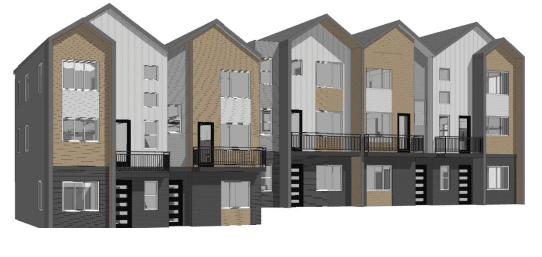

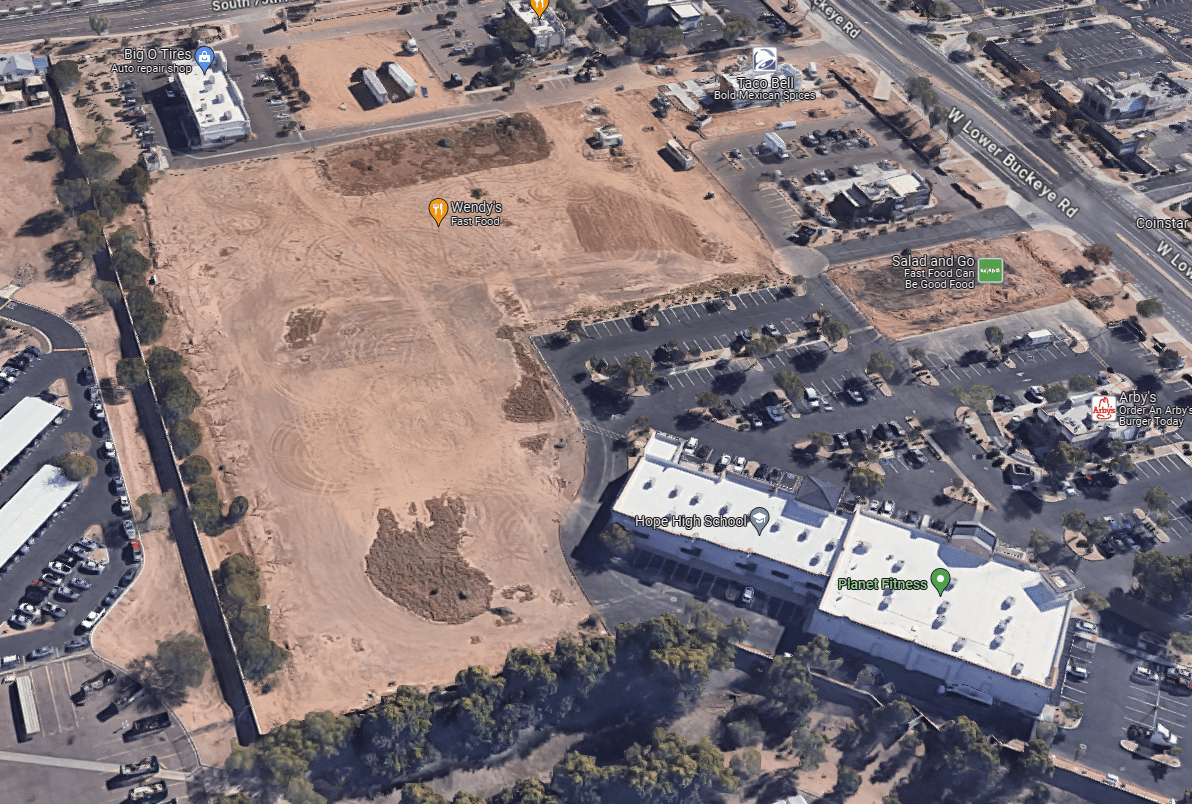

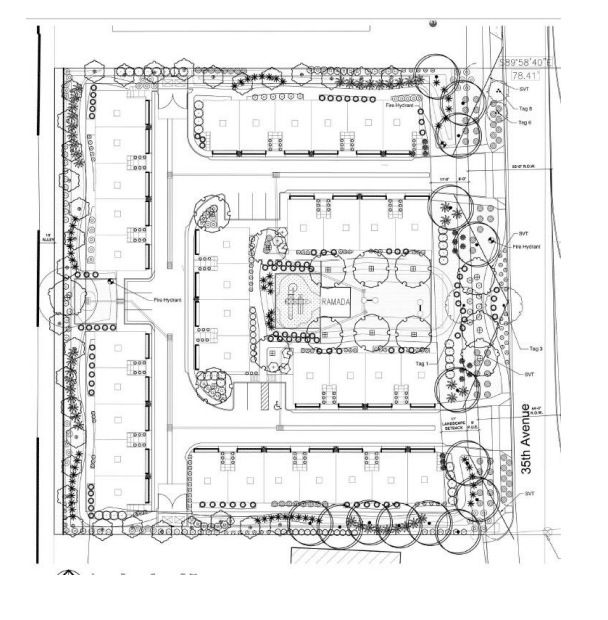

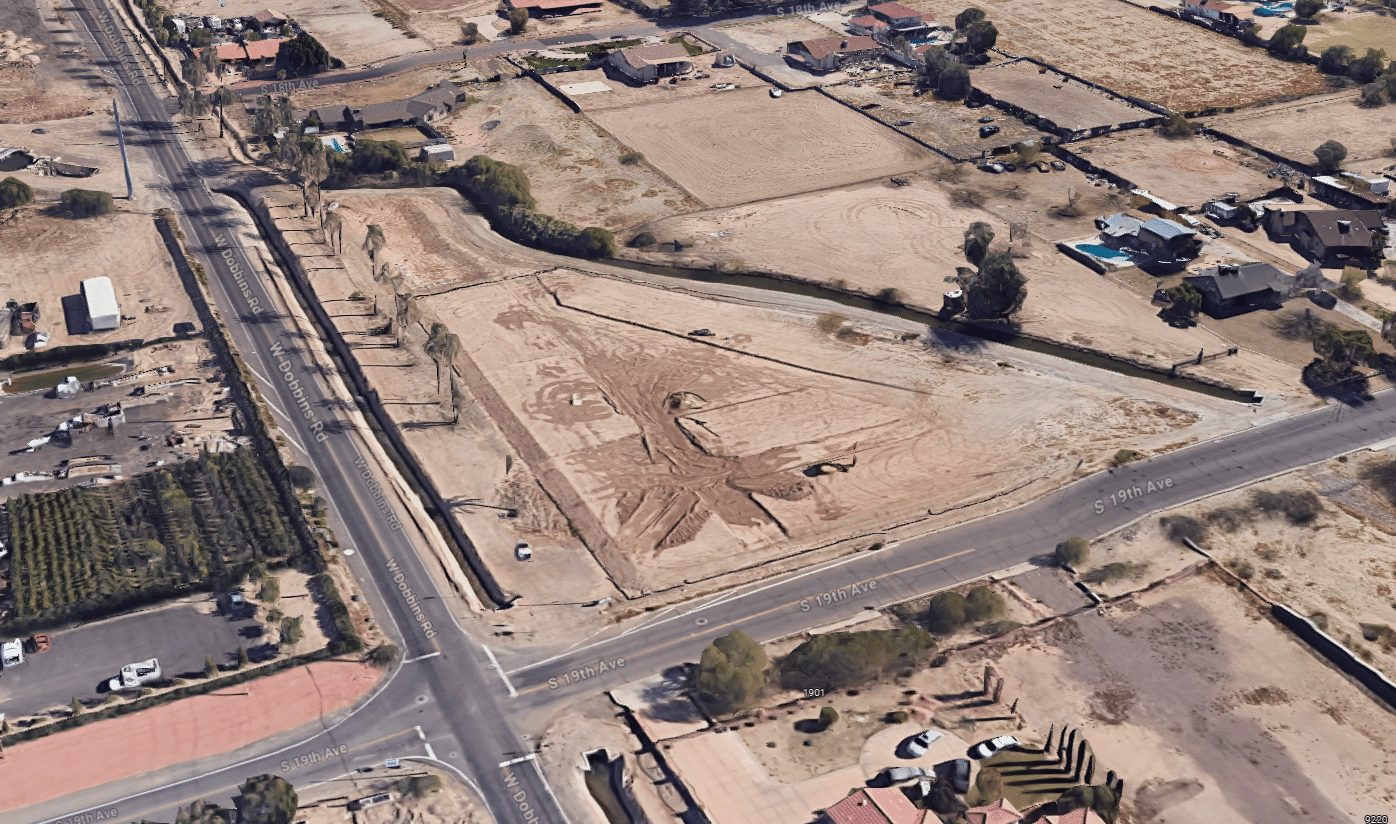

Grays Development Company, Inc. #6221 | COLORADO – ($1.5M Available)

Grays Development Company, Inc is a special purpose entity created by the principals of Lokal Homes. Lokal Homes is owned, managed, and operated by Coloradans with over 50 collective years of home building experience. Colorado is home to their entire team and provides them with a unique perspective on the market, product, and highest level of customer commitment. Lokal Homes has doubled the number of homes built nearly each year since inception and is now ranked a top 10 privately owned builder in Colorado. Along with building homes, Lokal Communities is the townhome building arm of Lokal Homes. Since 2015, Ignite Funding has lent Lokal and its affiliates over $212,000,000 without any issues.. Master Loan Amount: $7,000,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 10/9/25.