FIG Stowe Creek, LLC #6017 | ARIZONA – SOLD OUT

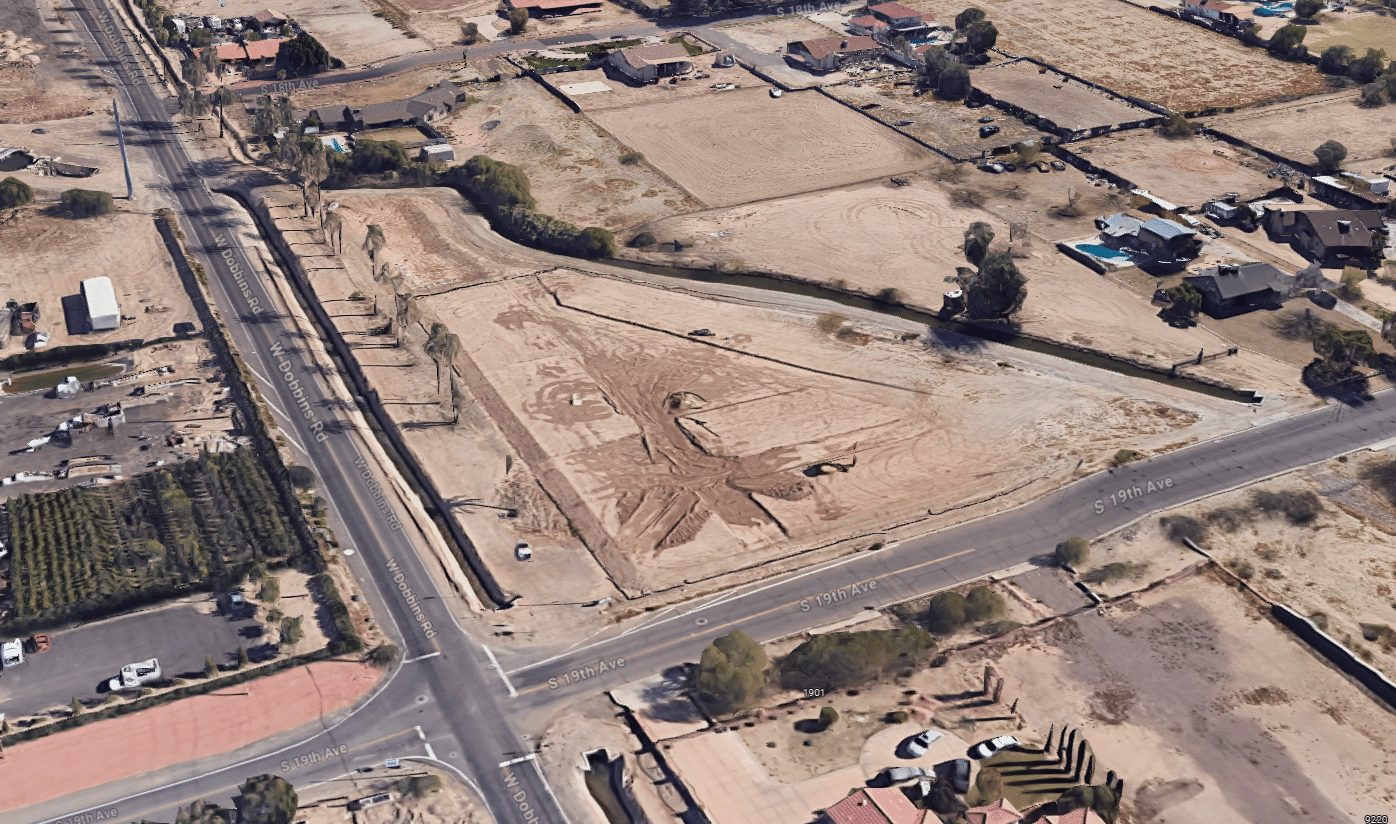

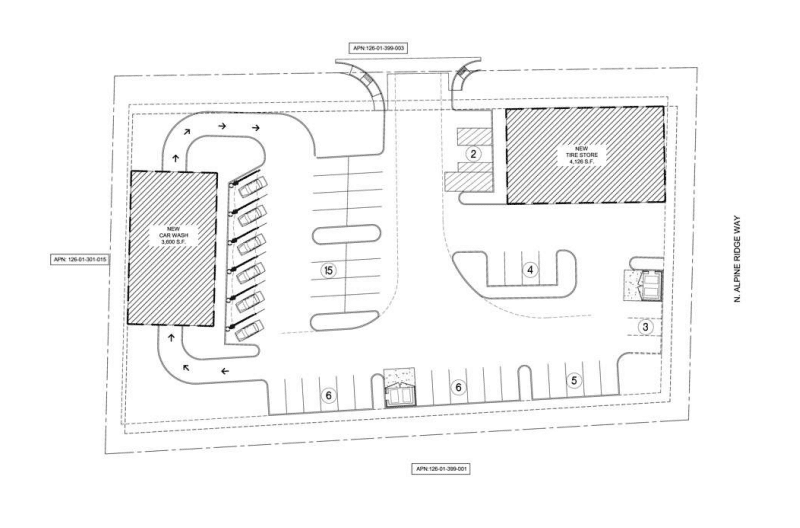

The collateral for this loan consists of nearly 2.15 acres of land in Phoenix, AZ. The current owner purchased the property in August of 2021 for $6,582,254 and has since obtained the proper zoning and entitlements to begin the development and ultimate construction of a 32-unit low rise, multifamily complex. With building permits in hand, our borrower will acquire the site and almost immediately begin construction of the property. With a build time of 12 months and a total cost of $11,360,000 (according to the appraisal detailed above), the borrower plans on refinancing the cash flowing asset upon stabilization of the property. The units will average 1,324 square feet in size and rent for $1,850 per unit. Master Loan Amount: $8,854,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional extension at maturity. Final maturity date is 5/6/25.