Rhino Holdings Nampa, LLC #6203 | IDAHO – FUNDED

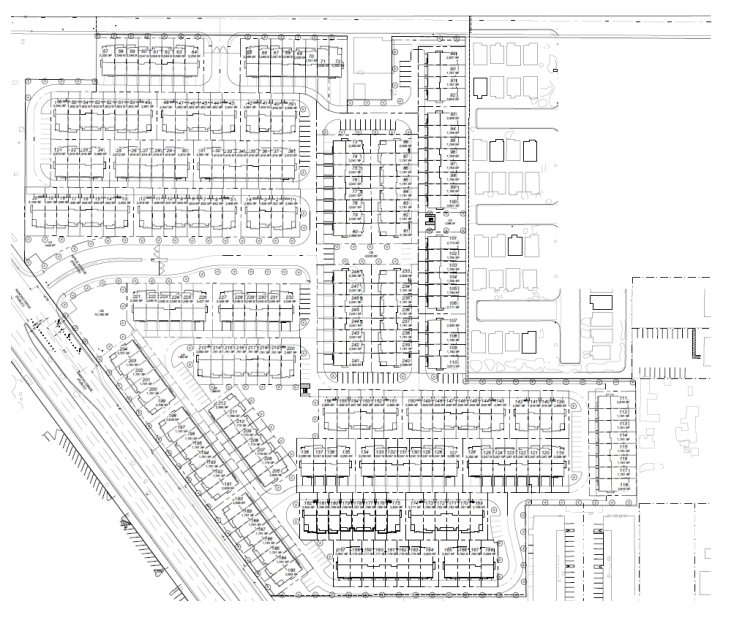

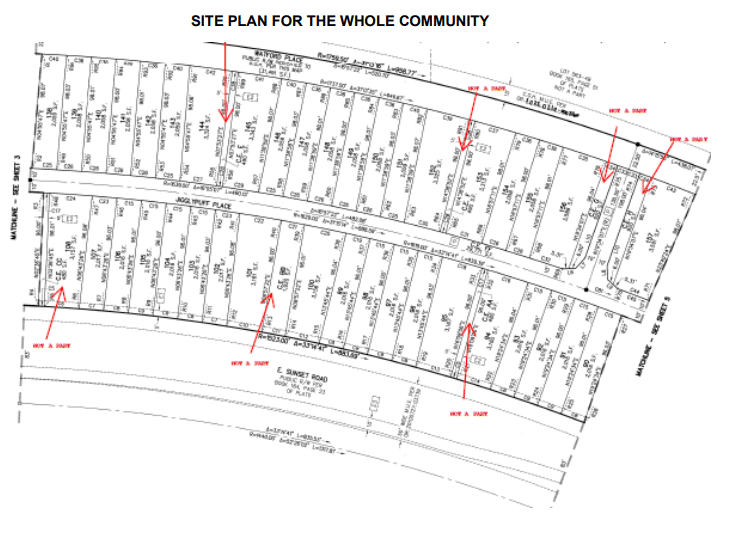

The collateral for this loan is an approximately 107,000 square foot building that is part of the District 208 Shopping Center, formally known as the Karcher Mall in Nampa, ID (approximately 22 miles west of downtown Boise, ID). Since acquiring the nearly 400,000 square foot indoor mall back in 2019, this space is the last piece of the puzzle that remains. The borrower demolished about 25% of the entire mall, added a few outparcels, and is turning the excess parking in the back of the shopping center into apartment buildings. While the apartments are not part of this collateral, the completion of them is paramount to getting this last parcel leased. Now that the apartments are almost complete, a tenant has signed a new lease. The new lease will commence after the apartments and tenant improvements have been completed. This completion is anticipated to be in August of this year. The tenant is a discount store and warehouse based in Pennsylvania who currently has nearly 20 locations. Loan Amount: $8,900,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000